Limit property tax increases to the rate of inflation while maintaining services

Taxes are increasing much more than the rate of inflation.

Why is the property tax increase greater than the rate of inflation?

In this time of financial hardship due to Covid, property tax increases should be kept close to the rate of core inflation which is forecast to be 1.6 – 2% in 2021. Council has approved a tax increase totalling 5.68%. An increase of 1% is for future large capital projects when the City’s Uncommitted Capital Reserves already stand at $166.5 million. An increase of almost 2% is for an additional 16 RCMP officers, 11 RCMP municipal employees and 12 firefighters.

Are the increases for police and fire needed urgently?

As a BlockWatch Captain, I have a major interest in community safety and am a strong supporter of our highly skilled and dedicated Richmond RCMP officers and firefighters. However, when police and fire services eat up about 44% of the City’s total annual budget, my accounting background tells me to demand facts and figures when senior RCMP and Fire-Rescue officers say that isn’t enough and ask Council to provide millions in new funding for more officers and firefighters.

The BC Government provides comparable police service statistics for the 31 municipalities with a population over 15,000 served by the RCMP. The 2019 report shows that of those 31 municipalities, Richmond has the lowest case load per officer and the fourth lowest crime rate. Richmond’s cost per capita for police services is higher than 40% of the other municipalities. The consultant’s report which recommended the additional firefighters said that they will not be needed until 2027.

The effect of postponing these increases

If you postpone the addition to Uncommitted Capital Reserves and the additional RCMP staff and firefighters, you reduce the 2021 tax increase from 5.68% to 2.69%, a far more reasonable figure in the present circumstances.

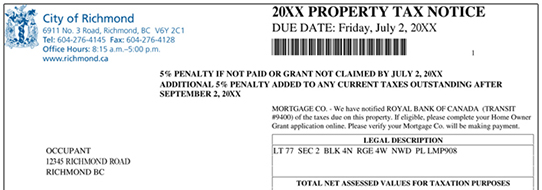

Richmond’s taxes are already higher than the City would have you believe

The City of Richmond states, “Richmond continues to be one of the cities with the lowest residential property tax rate in the Lower Mainland.” However, BC Government statistics show that, with the exception of Vancouver, Richmond’s taxes on a typical single family detached house are actually higher than those in the surrounding cities:

| City | Taxes & Charges |

|---|---|

| Vancouver | $7,548 |

| Richmond | $6,240 |

| Burnaby | $5,863 |

| Coquitlam | $5,851 |

| Surrey | $5,297 |

| Delta | $5,239 |

Charges include annual fees like garbage collection whether they are included in taxes or charged separately.

Other Richmond Issues

More rental housing in the City Centre rather than strata condos for investors

There continues to be an acute shortage of market rental housing units in Richmond's City Centre and yet Council only makes feeble token efforts to do something about it. It is important to require substantial rental housing in major new housing developments.

Read more here.

A strategy to faciltate the marketing of locally produced food and food products

Our supermarkets are importing food rather than buying food produced locally. There are steps Council can take now to turn that situation around.

Read more here.

Save our large trees and reduce our emissions from heating and cooling

There should be much higher fees to remove large trees that provide shade, oxygen production, carbon storage, bird and animal habitat, and natural beauty.

Read more here.

More support for young farmers starting out, not mega mansions taking farmland out of production

Non-farmers have been buying up Richmond farmland in order to build mega mansions that make it difficult to farm the land. Farmland prices are beyond what any farmer can afford.

Read more here.

More intercultural mutual respect, not isolation and mistrust

Both immigration and housing prices have increased dramatically. Foreign language signage has been an issue. These have resulted in inter-cultural isolation and mistrust.

Read more here.