My Blog

I am rarely blogging at the moment, just when something interesting crops up. I have written about current major political issues in Richmond BC, my community.

For entries more than two years old, the blog archive is here.

November 6, 2025. Richmond's Miserable Ranking in Study of Renter Friedliness in 235 Canadian Cities.

Richmond ranked 206th out of 235 cities in a Globe & Mail data-driven study indicating how poorly Richmond treats renters.

I hope that Richmond’s miserable ranking will spur Richmond City Councillors to do something substantial to make Richmond much more renter friendly. A municipal housing authority corporation to build affordable purpose-built rental housing on city owned land would be a good start provided the city retains ownership and full control over the housing to ensure it maximizes the benefits to Richmond residents.

When I have provided data to Richmond Council in the past on the dire situation for renters in Richmond on behalf of the Richmond Rental Housing Advocacy Group, Council habitually refers it to staff who reply with quibbles about the data and boasts about the number of housing units built in the last year. Council’s stubborn insistence on approving the construction of condos on our scarce suitable land, rather than insisting on purpose-built rental housing, has finally come home to roost. The condos sit vacant waiting for investors while renters have to live elsewhere and waste time and expense commuting to jobs in Richmond.

Survey Results:

Lower ranking means the city is more renter friendly. For example, Toronto is more friendly, ranked 57th out of 235.

Our neighbouring municipalities:

- Surrey 100

- Vancouver 138

- New Westminster 176

- Langley 179

- Burnaby 183

- Coquitlam 192

- Richmond 206

- Delta 224

How the Rankings were Derived

“Using monthly listing data from Rentals.ca, we ranked 235 cities (each with a population exceeding 20,000) on four attributes: Affordability, Availability, Stability, and Livability. Affordability highlights housing costs relative to local median incomes. Availability signals how competitive the search for a unit will be, not only among people within the city, but also among people in the neighbouring communities. Stability helps identify markets where prices and availability have remained steady over the past five years. Livability looks at the daily experience of living in a place: how easy it is to get around, run errands, and participate in the community.”

A Deeper Dive into Richmond Data

- Average Rent (Summer 2025) $2,771

- YoY change -3.4%

- Population 242,966

- Median income $79,000

- Average monthly shelter cost for renters $1,672

- Renter households that spent >30% income on shelter costs 44.5%

RANK (OF 235 CITIES)

- Affordability 221

- Availability 131

- Stability 217

- Livability 53

NEIGHBOURHOOD SCORES (OUT OF 100)

- Overall 57

- Pedestrian-friendly 58

- Car-friendly 70

- Proximity to groceries 60

- Proximity to shops 38

Note that on affordability alone, Richmond would have done even worse ranked 221 out of 235.

October 9, 2024. Investor ownership of Richmond condos is an impediment to rentals.

Interview with Gloria Macarenko, host of the CBC program On the Coast.

Available here.

Why investor ownership of condos replaces purpose-built rental housing and what can be done about it.

Although this is a video of the interview, it was broadcast on radio only and I didn't realize the video was being recorded.

October 7, 2024. One-third of Richmond condos are investment properties: Stats Canada.

Aricle published in Richmond News.

By Maria Rantanen

Housing advocate calls for city to buy land for rental buildings.

One-third of all condos in Richmond are considered "investment properties" by Statistics Canada.

Of the 32,240 condos in Richmond, 10,980, or 34.1 per cent, are owned as investments, according to a report from Statistics Canada releasedon Thursday. This is slightly lower, however, than the average in the Vancouver Metropolitan Area, where 34.2 per cent of condos were considered investment properties. But only 12.7 per cent of single-detached homes, a total of 2,940, are considered investments, out of a total of 23,170 single-detached homes in Richmond.

Statistics Canada flagged some cities in Ontario, such as London and Windsor, where condos were 85.5 per cent and 64.4 per cent, respectively, of properties were classified as investments. StatsCan noted a potential explanation was that some large condo buildings were owned entirely by one business and run like a rental building. This was possible due to tax incentives in some Ontario cities.

John Roston, coordinator for the Richmond Rental Housing Advocacy Group, noted the median square footage of investor-owned Richmond condos has shrunk over the years.

"The conclusion, in our view, is that Richmond condos are getting smaller when we need them to get bigger to accommodate the families most in need and that a sizeable proportion of the people who purchase them have a strong motive for a rapid rise in purchase prices and eviction of tenants when they do," Roston wrote in a letter to Richmond mayor and council.

"Pre-zoning land for rental housing keeps land purchase costs low enough that market rental housing developers can afford to buy it and they have a motive to build larger apartments to meet the strong demand for them," he added. Furthermore, he suggested the city should buy land that can be leased for "the construction of low-income rental housing that is financed by higher levels of government."

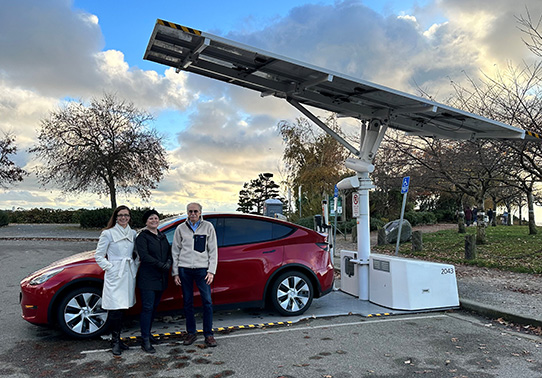

November 15, 2023. BC Government support for electric vehicle charging.

A document from John Roston on EV charging discussed with Minister of Energy, Mines and Low Carbon Innovation Josie Osborne and Richmond-Steveston MLA Kelly Greene.

Objective 1: Increase EV charging in existing multi-family buildings (MURBs).

Actions:

a. Provide a simple document for strata councils that gives five examples of different size projects and what they cost. They need a ballpark estimate before considering preparation of a plan.

b. Increase the 75% subsidy for developing the EV Ready Plan by increasing the cap on total cost from $3,000 to $5,000.

c. Create two separate funds for the EV Ready Plan subsidy with a larger allocation to the fund for municipalities that cover the other 25% of the cost. Accompanied by a sales pitch for developing a plan at no cost even if the strata does not implement it. They are more likely to decide to implement it once they have a plan.

d. Provide more standard documentation for developing an EV Ready Plan. Sample diagrams. Fill in the blanks. Reduce the time and cost of producing a plan.

e. Subsidize the installation of electrical wiring and outlets but not the installation of charging units (EVSEs) not currently required. They are likely to be obsolete before they are used.

Objective 2: Encourage installation of level 3 public charging rather than level 2.

Action:

Public station installation subsidies should be directed to fast level 3 charging which lets more consumers charge at each public station. Emphasis should be on working with existing gas stations that provide restrooms and food.

Objective 3: Encourage EV owners charging at home from 11 pm to 7 am.

Actions:

a. Implement regulation requiring EV dealers to set the charging timer to after 11 pm before delivering vehicle to owner.

b. Stop penalizing EV owners (who pay for charging at the Step 2 rate) by implementing Step 1 rate if electrical consumption takes place from 11 pm to 7 am. Keep existing Step 2 consumption threshold but only for consumption from 7 am to 11 pm.

c. Abandon BC Hydro proposed rate change which continues to penalize EV owners who pay for charging at the Step 2 rate (+4.33 cents/kWh). Further, it increases the rate (+5 cents/kWh) for consumption from 4 pm to 9 pm which discourages EV owners from switching from natural gas to heat pumps and electricity for hot water and cooking.

Objective 4: Develop time shift plan for EV owners using bi-directional charging and switching from natural gas to heat pumps and electricity for hot water and cooking.

Actions:

a. Prepare for implementation in 2025 of bi-directional EV charging which allows for switching to power from the EV battery to meet household electrical demand. Enables major reductions in peak load on the electrical grid from 4 pm to 9 pm. Also provides emergency backup power.

b. Use EV battery to supply whole house consumption from 4 pm to 9 pm. Switch back to grid supply at 9 pm. Charge vehicle from 11 pm to 7 am.

c. Implement 50% subsidy for installation of a bi-directional charging unit and a whole house power transfer switch to a combined total cost of $5,000. Although the total cost is currently at least $8,000, this is for more complex systems than required. The cost of simpler systems will come down by 2025.

For entries more than two years old, the blog archive is here.

2022 Municipal Election

Rental advocate John Roston running for Richmond mayor's chair

Richmond News, July 11, 2022,

by Maria Ratanen.

Rental housing advocate and FarmWatch member John Roston will challenge long-time Richmond Mayor Malcolm Brodie in the October municipal election. The Steveston resident has been named as the RITE Richmond mayoral candidate.

Roston ran in the May 2021 by-election to replace Kelly Greene, who was elected as an NDP MLA in the previous fall’s provincial election. Roston placed eighth in the by-election, won by retired VPD superintendent Andy Hobbs.

Joining Roston on the RITE slate are current councillors Carol Day and Michael Wolfe as well as farming advocate Laura Gillanders – who ran for the Green Party in the last federal election – and Jerome Dickey, a local businessman and entrepreneur.

The municipal elections are set for Oct. 15 when a mayor, eight councillors and seven school trustees will be elected.

Mayor candidate Roston encourages youth to pick up electoral torch

Richmond News, October 16, 2022,

by Valerie Leung.

“This is the start, not the end.”

Richmond’s mayoral candidate John Roston is encouraging more young people to run in elections. Roston, while not surprised by his loss against incumbent Malcolm Brodie in the 2022 Civic Election in Richmond, hopes more younger candidates will step up to the political plate in future elections.

The RITE candidate said he was told by many young voters that they appreciated him “running so they could vote for somebody they believe in.” “We have a lot of hope in the younger generations,” said Roston. “In the short run, just get them out to vote. And in the long run, they will do it themselves, they will run, and this will be much better so I think.”

Roston received 26.5 per cent of votes from Richmond voters (9,304 votes.) He also ran in the 2018 election and the 2021 by-election but lost in both.

Roston told supporters at the Richmond Curling Club, where RITE, Richmond Citizen Association and some independent candidates gathered after the polls closed, that he had never thought about running for mayor until he was approached by incumbent Carol Day, also from the RITE Slate.

“At first I thought I didn’t hear her correctly, and then I said, ‘that is crazy. It is impossible for me to beat Malcolm Brodie.’” However, Day said it, “doesn’t matter.” Citing veteran councillor Harold Steves, she noted that the most important part of running was “talking about the issues and giving people a chance to vote for someone they trust.”

Besides, added Roston, it’s fun. “If anyone of you gets a chance to run, you should run, because getting out there and talking to people about the issues is actually a lot of fun,” said Roston.